...the monthly, Open Access Publisher.

...the monthly, Open Access Publisher.

...the monthly, Open Access Publisher.

...the monthly, Open Access Publisher.

Research - (2021) Volume 15, Issue 3

Received: 16-Dec-2021 Published: 07-Jan-2022

This study explores the trade relationship between Guangxi province and ASEAN countries under the China-ASEAN Free Trade Area (CAFTA) agreement. We used the gravity model of trade and econometric regression model to carry out the study with data obtained from 2002 to 2018.

The empirical results show that the trade relation between Guangxi province and ASEAN countries has significant growth and different characteristics at different stages. The results also show that GDP of ASEAN countries, FDI of Guangxi province and population of Guangxi province have positive and significant effects on trade. In particular, Guangxi’s FDI is identified as one of the factors which helps to promote trade relations between Guangxi province and ASEAN countries, and has a positive correlation coefficient of 0.207 at the 5% significance level. Based on the findings, we suggest that; first, Guangxi province should increase the import of products from ASEAN countries to maintain its trade balance and promote economic development; second, Guangxi province needs to strengthen its market development in Indonesia, Thailand and Philippines on the basis of existing cooperation with Vietnam, Singapore and Malaysia; and finally, the distance between Guangxi province and ASEAN countries which tend to hinder the development of bilateral trade should be improved through infrastructural development.

Trade relationship, influencing factors, free trade, ASEAN countries, China

Since 1991, China made several efforts to negotiate with the Association of Southeast Asian Nations (ASEAN), aimed at establishing a regional economic cooperation area with the largest population and the largest number of developing countries in the world. This cooperation named, China-ASEAN Free Trade Area (CAFTA) gained much recognition in 2002, when the 6th China-ASEAN Summit decided that CAFTA will be built in 2010, which then marked the formal beginning of the construction of CAFTA.

The construction of CAFTA went through three stages: the first stage was from 2002 to 2010, in which the tariff of both sides was greatly reduced, and by the end of 2010, the tariff of most products had been reduced to nearly zero; the second stage was from 2010 to 2015, in which the free trade area was fully built and both sides realized a relatively open trade market system; and the third stage started in 2016, during which the construction of the free trade area was consolidated and improved (Gregory et al., 2011). The analysis of these three stages helps to explain the development and current situation of the relationship of merchandise trade between Guangxi province and ASEAN countries and it enables people to understand the influence of different factors on the trade between them in different stages and therefore helps to put forward constructive suggestions for improvement in the development of trade between the two blocks. This paper therefore seeks to identify the key factors influencing trade between Guangxi Province in China and some selected ASEAN countries, identifying the existing challenges affecting effective trade between them, and how to overcome them. The remaining part of the paper is organized as follows: Section 2 contains the literature review; Section 3 describes the methodology and data employed in the analysis; Section 4 presents and discusses the results; and Section 5 concludes the paper.

Several studies have been carried out about the degree of bilateral trade dependence by analyzing the current situation of trade between Guangxi province and some ASEAN countries, and other scholars have also drawn different conclusions and explanations from various perspectives. While some scholars believed that foreign trade in Guangxi has a greater dependence on ASEAN countries, and the trade complementarity of both sides has been strengthened with the deepening of trade (Wen, 2019). Some other scholars have pointed out that the imbalance of trade of Guangxi province with ASEAN countries would seriously affect the economic development of Guangxi, hence the import volume of Guangxi province should be increased (Jiang, 2012). In addition, there are other findings which suggest that the development of e-commerce, port efficiency and improvement in the Customs environment will promote export businesses between Guangxi province and ASEAN countries (Zuo, 2017). In terms of trade potentials, although there is a huge space for development of bilateral service trade, merchandise trade accounts for the vast majority of bilateral trade, and its potential cannot be underestimated (Wang et al., 2018).With the help of trade gravity model, some scholars have analyzed the potential of merchandise trade between Guangxi province and ASEAN countries, and found that GDP and trade facilitation have positive effects on bilateral trade, while bilateral distance, population and bilateral trade development are negatively correlated (Cha et al., 2012, Wen et al., 2019) Some scholars have also included Foreign Direct Investment (FDI) in the gravity model to analyze the trade potential between Fujian province and ASEAN countries, and found that FDI has a positive impact on bilateral trade (Liao, 2016). Therefore, although scholars have done considerable amount of researches on the current situation and trade potentials between Guangxi province and ASEAN countries, most of the existing studies focused mainly on the situation in a certain period, without considering the different situations in different stages, and the data employed was also limited in scope. The innovativeness of this paper is therefore, based on the three stages of the construction of CAFTA. This paper specifically studies the merchandise trade between Guangxi province and ASEAN countries with the introduction of FDI as one of the key variables into the trade gravity model, and draws a conclusion in different perspectives from the above literature.

Trade volumes between Guangxi province and ASEAN countries

In recent years, Guangxi province and ASEAN countries have maintained very close trade relationships, and as a result, the import and export volume between them has been on the increase. According to statistics, in 2002 and 2018, the total import and export volumes between Guangxi province and ASEAN countries was 61,768 and 29,342.79 million USD (United States Dollars) respectively, with an average annual growth of nearly 1.7 billion USD. As shown in Table 1, in the first stage of CAFTA construction, due to the sharp reduction of tariffs between Guangxi province and ASEAN countries, the import and export trade achieved a substantial growth, especially in 2007, when the total import and export volume increased by 58.45% year-on-year. Moreover, the import volume between the two regions increased by 113.61% in 2006. In the second stage, with the completion of CAFTA, the import and export volume of Guangxi province and ASEAN countries grew steadily. Although the import volume in 2012 and 2014 slowed down, the import and export volume in 2015 respectively increased by 46.02% and 246.76% year-on-year. This might be due to the upgrading of CAFTA and the further strengthening of Sino-Vietnamese and Sino-Malaysian relationships. In entering the third stage, due to the global economic downturn, the growth rate of import and export trade between Guangxi province and ASEAN countries also slowed down. Although the export and import volumes have shown negative growth for many times, the total foreign trade volume still kept growing.

| Year | Total volume of bilateral imports and exports | % Increase | Export of Guangxi to ASEAN | % Increase | Import of Guangxi to ASEAN | % Increase | Trade balance of Guangxi with ASEAN | Trade balance of Guangxi with the world | FDI in Guangxi |

|---|---|---|---|---|---|---|---|---|---|

| 2001 | 40888 | â?? | 25223 | â?? | 15665 | â?? | 9558 | 67393 | 38415 |

| 2002 | 61768 | 51.07 | 43856 | 73.87 | 18457 | 17.82 | 25399 | 58518 | 41726 |

| 2003 | 82174 | 33.04 | 54855 | 25.08 | 27319 | 48.01 | 27536 | 74841 | 45619 |

| 2004 | 99572 | 21.17 | 63155 | 15.13 | 36417 | 33.3 | 26738 | 50261 | 29579 |

| 2005 | 121803 | 22.33 | 82485 | 30.61 | 39318 | 7.97 | 43167 | 57193 | 37866 |

| 2006 | 181848 | 49.3 | 97862 | 18.64 | 83986 | 113.61 | 13876 | 52328 | 44740 |

| 2007 | 288145 | 58.45 | 172457 | 76.22 | 115687 | 37.75 | 56770 | 94948 | 68396 |

| 2008 | 395717 | 37.33 | 269898 | 56.5 | 125818 | 8.76 | 144080 | 146055 | 97119 |

| 2009 | 491227 | 24.14 | 358606 | 32.87 | 132622 | 5.41 | 225984 | 253620 | 103533 |

| 2010 | 649099 | 32.14 | 455752 | 27.09 | 193347 | 45.79 | 262405 | 151367 | 91200 |

| 2011 | 947088 | 45.91 | 675152 | 48.14 | 271938 | 40.65 | 403214 | 158635 | 101381 |

| 2012 | 1195279 | 26.21 | 924323 | 36.91 | 270956 | -0.36 | 653367 | 146314 | 74853 |

| 2013 | 1582929 | 32.43 | 1252150 | 35.47 | 330780 | 22.08 | 921370 | 455308 | 70008 |

| 2014 | 1973841 | 24.7 | 1701625 | 35.9 | 272217 | -17.7 | 1429408 | 810703 | 100119 |

| 2015 | 2882291 | 46.02 | 1938400 | 13.91 | 943948 | 246.76 | 994452 | 478925 | 172208 |

| 2016 | 2748038 | -4.66 | 1486308 | -23.32 | 1261731 | 33.67 | 224577 | -183826 | 88845 |

| 2017 | 2789197 | 1.5 | 1564098 | 5.23 | 1225089 | -2.9 | 339009 | -229865 | 82272 |

| 2018 | 2934279 | 5.2 | 1795043 | 14.77 | 1139235 | -7.01 | 655808 | 325970 | 50590 |

Source: Guangxi Statistical Yearbook 2019. |

|||||||||

From the perspective of trade balance, from 2002 to 2018, Guangxi’s merchandise trade with ASEAN maintained a large trade surplus for a long time, while the surplus of Guangxi’s trade with the world has also been large. Since the construction of CAFTA was announced in 2001, the volume of merchandise export trade between Guangxi and ASEAN countries increased sharply. In the first stage, Guangxi’s merchandise exports to ASEAN countries were much larger than its imports, and its trade surplus expanded. In the second stage of construction of CAFTA, Guangxi’s merchandise export volume to ASEAN countries still maintained a high proportion, and the trade surplus continued to expand, and in 2014, the surplus exceeded 14 billion USD, representing about 56 times of the initial construction. In the third stage, this trend was eased, and the trade surplus was generally lower than the level in 2015, and the import and export volumes of commodities also decreased in the same period.

Foreign direct investment in Guangxi province

Foreign Direct Investment (FDI) is often seen as a primary driving force in influencing global economies, including China (Wan et al., 2019). The attractiveness of FDI in China has not changed over the years, especially in 2020 in spite of the outbreak of the Coronavirus Disease 2019 (COVID-19). Foreign direct investment therefore helps to promote the economic development of a country or region, and the increase in Guangxi province of the introduction of foreign capital may be conducive for the merchandise trade between the province and ASEAN countries.

As shown in Table 1, from 2002 to 2018, the amount of FDI in Guangxi province showed an unstable trend. In the first stage of the construction of the free trade area, FDI in Guangxi Province decreased and then increased later.

The lowest point appeared in 2004, when the investment was only 295.79 million USD and the growth rate of bilateral trade was the lowest. The reduction of investment in China in 2003 might be due to the outbreak of severe Acute Respiratory Syndrome (SARS) in the world at the time. Since then, the growth of FDI has been considerably high, exceeding 1 billion USD in 2009. In the following two years, bilateral trade also grew rapidly. However, after entering the second stage, the amount of FDI in Guangxi Province decreased rapidly. The investment amount in 2012 and 2013 was only equivalent to that in 2007, and the growth rate of trade volume in the subsequent years also began to decline. By the third stage, the amount of FDI continued to decline. In 2018 for instance, the amount of FDI was 505.9 million USD, which was the lowest level in nearly ten years. At the same time, the bilateral trade volume at this stage was also at a lower growth state.

Trade proportion of Guangxi Province and ASEAN countries

It has also been established that ASEAN countries have strong trade relationship with Guangxi province of China, because the province’s economic development largely depends on these countries (Foo et al., 2019). From Table 2, the proportion of merchandise trade volume between Guangxi province and ASEAN countries’ total foreign trade was far less than that in Guangxi’s total foreign trade. Moreover, in recent years, the bilateral trade volume accounted for about 50% of Guangxi’s total foreign trade. In the first and second stages of CAFTA construction, the proportion of merchandise trade volume between Guangxi and ASEAN countries in the total foreign trade volume of both sides has been increasing. For Guangxi province, the proportion of bilateral trade in total foreign trade increased from 25.42% in 2002 to 56.23% in 2015; for ASEAN countries, the proportion of bilateral trade in total foreign trade of ASEAN countries exceeded 1% for the first time in 2015. Having been affected by the global economy, during the third stage, the proportion of merchandise trade volume of Guangxi province and ASEAN countries both decreased, but the overall trend has been relatively stable.

| Year | Total foreign trade volume of Guangxi | Total foreign trade volume of ASEAN | Proportion of Guangxi - ASEAN trade volume to the total foreign trade of Guangxi (%) | Proportion of Guangxi - ASEAN trade volume to the total foreign trade of ASEAN (%) |

|---|---|---|---|---|

| 2002 | 243032 | 75490000 | 25.42 | 0.08 |

| 2003 | 319173 | 85890000 | 25.75 | 0.1 |

| 2004 | 428847 | 105700000 | 23.22 | 0.09 |

| 2005 | 518289 | 121860000 | 23.5 | 0.1 |

| 2006 | 667398 | 141240000 | 27.25 | 0.13 |

| 2007 | 927686 | 159440000 | 31.06 | 0.18 |

| 2008 | 1324179 | 189210000 | 29.88 | 0.21 |

| 2009 | 1420599 | 151000000 | 34.58 | 0.33 |

| 2010 | 1770609 | 196790000 | 36.66 | 0.33 |

| 2011 | 2333084 | 235700000 | 40.59 | 0.4 |

| 2012 | 2947369 | 242940000 | 40.55 | 0.49 |

| 2013 | 3283690 | 247680000 | 48.21 | 0.64 |

| 2014 | 4055305 | 247340000 | 48.67 | 0.8 |

| 2015 | 5126215 | 220900000 | 56.23 | 1.3 |

| 2016 | 4789694 | 217140000 | 57.37 | 1.27 |

| 2017 | 5721023 | 249610000 | 48.75 | 1.12 |

| 2018 | 6233834 | 278060000 | 47.07 | 1.06 |

Source: Guangxi Statistical Yearbook 2019 and Comtrade database. |

||||

Flow of merchandise trade between Guangxi province and ASEAN countries

There appears to be some differences in the amount of merchandise trade between Guangxi province and ASEAN countries, and the merchandise trade between Guangxi and ASEAN countries is mainly with Vietnam. This is so because Vietnam has always been the backbone of trade between Guangxi province and ASEAN countries, while other countries have also actively carried out trade cooperation with Guangxi province. As shown in Table 3, in the first stage of CAFTA construction, the merchandise trade volume between Guangxi province and ASEAN countries ranked high in order of Vietnam, Indonesia, Thailand, Malaysia, Singapore and the Philippines according to the occurrence frequency of each country in each rank. In the second stage of CAFTA construction, Vietnam, Indonesia, Singapore, Malaysia, Thailand and the Philippines are ranked in order of high volume. Compared with the first stage, Singapore’s ranking has increased, while Thailand’s has declined. It is worth noting that Thailand took over Indonesia’s place in 2015 and became the second. In the third stage, Vietnam, Indonesia, Singapore, Malaysia, Thailand, and the Philippines ranked in the high order, basically consistent with the second stage, and Singapore remained in the third place.

| Year | First place | Second place | Third place | Fourth place | Fifth place | Sixth place |

|---|---|---|---|---|---|---|

| 2002 | Vietnam | Thailand | Malaysia | Indonesia | Singapore | Philippines |

| 2003 | Vietnam | Malaysia | Thailand | Indonesia | Singapore | Philippines |

| 2004 | Vietnam | Malaysia | Indonesia | Thailand | Singapore | Philippines |

| 2005 | Vietnam | Indonesia | Singapore | Thailand | Malaysia | Philippines |

| 2006 | Vietnam | Indonesia | Thailand | Singapore | Malaysia | Philippines |

| 2007 | Vietnam | Singapore | Indonesia | Thailand | Malaysia | Philippines |

| 2008 | Vietnam | Indonesia | Thailand | Malaysia | Singapore | Philippines |

| 2009 | Vietnam | Malaysia | Indonesia | Singapore | Thailand | Philippines |

| 2010 | Vietnam | Indonesia | Thailand | Malaysia | Singapore | Philippines |

| 2011 | Vietnam | Indonesia | Malaysia | Thailand | Singapore | Philippines |

| 2012 | Vietnam | Indonesia | Singapore | Malaysia | Thailand | Philippines |

| 2013 | Vietnam | Indonesia | Malaysia | Singapore | Thailand | Philippines |

| 2014 | Vietnam | Indonesia | Singapore | Malaysia | Thailand | Philippines |

| 2015 | Vietnam | Thailand | Singapore | Malaysia | Philippines | Indonesia |

| 2016 | Vietnam | Indonesia | Singapore | Malaysia | Thailand | Philippines |

| 2017 | Vietnam | Indonesia | Singapore | Malaysia | Thailand | Philippines |

| 2018 | Vietnam | Thailand | Malaysia | Indonesia | Singapore | Philippines |

Source: Guangxi Statistical Yearbook, 2019. |

||||||

Merchandise trade between Guangxi province and ASEAN countries

In the merchandise trade between Guangxi Province and ASEAN countries, the Trade Combined Degree (TCD) can be used to measure the degree of dependence or closeness of trade between the two regions. Trade combined degree refers to the ratio of the export volume of a country or region A to country B or region in the total export volume of country or region A and the proportion of the total import volume of country or region B in the world import volume. Taking the trade combined degree of Guangxi with ASEAN countries as an example; the formula is expressed as follows:

TCDga=(Xga/Xg)/(Ma/Mw) (1)

Where;

TCDga=Trade combined degree of Guangxi to ASEAN countries

Xga=Export of Guangxi to ASEAN countries

Xg=Total export volume of Guangxi

Ma=Total import volume of ASEAN countries

Mw=Total import volume of the world

As a rule of thumb, the larger the TCD index, the closer the trade relationship between the two sides. When TCD>1, it shows that Guangxi and ASEAN countries have a high degree of trade dependence and their markets may be important export markets for each other. When TCD<1, it indicates that the trade relation between Guangxi and ASEAN countries is relatively distant (Wen et al, 2019). As shown in Tables 4 and 5 below, the trade combined degree of Guangxi to ASEAN countries and the trade combined degree of ASEAN and ASEAN countries to Guangxi are obtained. The subscripts in the table represent Guangxi (g), ASEAN (a), Vietnam (V), Indonesia (I), Singapore (S), Malaysia (M), Thailand (T) and Philippines (P).

| Year | TCDga | TCDgv | TCDgi | TCDgs | TCDgm | TCDgt | TCDgp |

|---|---|---|---|---|---|---|---|

| 2002 | 5.42 | 76.74 | 2.81 | 0.62 | 1.21 | 1.8 | 1.32 |

| 2003 | 5.49 | 69 | 3.38 | 0.43 | 1.16 | 1.71 | 0.81 |

| 2004 | 5.04 | 56.43 | 4.17 | 0.42 | 1.71 | 2.31 | 0.84 |

| 2005 | 5.38 | 65.88 | 3.55 | 0.76 | 1.03 | 1.28 | 1.09 |

| 2006 | 5.12 | 57.65 | 3.47 | 0.98 | 0.75 | 1.38 | 1.24 |

| 2007 | 6.44 | 63.51 | 2.42 | 0.93 | 0.92 | 1.46 | 1.27 |

| 2008 | 6.56 | 63.33 | 1.54 | 0.57 | 1.13 | 1.39 | 2.7 |

| 2009 | 7.62 | 67.57 | 1.11 | 0.75 | 1.92 | 1.08 | 1.53 |

| 2010 | 7.83 | 77.64 | 1 | 0.5 | 1.18 | 1.04 | 1.63 |

| 2011 | 8.83 | 83.05 | 2.76 | 0.44 | 0.93 | 1.05 | 1.67 |

| 2012 | 9.33 | 88.06 | 2.84 | 0.43 | 1.39 | 0.39 | 1.48 |

| 2013 | 10.38 | 88.26 | 1.03 | 1.13 | 0.93 | 0.84 | 1.11 |

| 2014 | 11.07 | 81.33 | 2.4 | 1.46 | 0.79 | 0.53 | 1.25 |

| 2015 | 10.89 | 64.72 | 1.06 | 1.38 | 0.47 | 0.44 | 1.83 |

| 2016 | 10 | 55.73 | 1.14 | 0.89 | 0.73 | 0.59 | 1.19 |

| 2017 | 8.46 | 42.48 | 1.61 | 1.2 | 0.89 | 0.94 | 1.94 |

| 2018 | 7.89 | 41.86 | 1.1 | 0.8 | 1.03 | 0.64 | 0.62 |

Source: Sorted according to "Guangxi Statistical Yearbook", ASEAN Stats and World Bank Database. |

|||||||

| Year | TCDag | TCDvg | TCDig | TCDsg | TCDmg | TCDtg | TCDpg |

|---|---|---|---|---|---|---|---|

| 2002 | 3.38 | 63.2 | 0.32 | 0.32 | 0.99 | 1.5 | 0.88 |

| 2003 | 3.78 | 71.71 | 0.58 | 0.12 | 1.53 | 1.09 | 0.05 |

| 2004 | 3.28 | 56.58 | 1.18 | 0.11 | 1.28 | 0.51 | 0.35 |

| 2005 | 2.88 | 49.83 | 0.56 | 0.29 | 0.37 | 0.58 | 0.07 |

| 2006 | 4.51 | 72.79 | 1.27 | 0.14 | 0.55 | 0.94 | 2.51 |

| 2007 | 4.71 | 67.5 | 1.76 | 0.51 | 0.9 | 0.92 | 0.91 |

| 2008 | 3.67 | 38.44 | 4.13 | 0.51 | 1.07 | 0.77 | 0.81 |

| 2009 | 3.66 | 33.96 | 3.54 | 0.52 | 1.61 | 0.91 | 0.45 |

| 2010 | 3.6 | 27.85 | 5.03 | 0.77 | 1.32 | 1.69 | 0.72 |

| 2011 | 3.8 | 28.36 | 5.38 | 0.39 | 1.38 | 0.81 | 2.72 |

| 2012 | 2.95 | 17.01 | 4.67 | 0.75 | 0.46 | 0.95 | 2.94 |

| 2013 | 3.57 | 12.89 | 6.14 | 0.73 | 3.4 | 1.68 | 2.88 |

| 2014 | 2.54 | 8.15 | 3.26 | 0.45 | 1.56 | 2.2 | 5.8 |

| 2015 | 5.96 | 29.96 | 6.44 | 0.23 | 1.92 | 1.24 | 4.49 |

| 2016 | 7.37 | 37.57 | 7.28 | 0.22 | 1.03 | 0.89 | 2 |

| 2017 | 5.8 | 29.08 | 2.2 | 0.26 | 1.27 | 0.95 | 3.02 |

| 2018 | 5.46 | 24.02 | 2.33 | 0.23 | 1.73 | 2.78 | 2.5 |

Source: Guangxi Statistical Yearbook 2019, ASEAN Stats and World Bank Database. |

|||||||

From the horizontal perspective, first of all, the TCDs of Guangxi and ASEAN of each other are both greater than 1, which shows that the merchandise trade between Guangxi and ASEAN is closely related, and both sides are important export markets for each other; at the same time, the Trade Combined Degree (TCDga) of Guangxi to ASEAN is higher than that of ASEAN to Guangxi (TCDag) for 17 years, which indicates that Guangxi is more dependent on ASEAN markets. The trade combined degree of Guangxi and Vietnam to each other is far greater than 1, which supports the situation mentioned above: among ASEAN countries, Vietnam has always been the first trade partner of Guangxi, and Guangxi’s exports mainly flow to Vietnam. Secondly, the trade combined degree of Guangxi with Indonesia and the Philippines is above one. Although the merchandise trade volume between Guangxi and the Philippines is small, Guangxi has a high degree of trade dependence on the Philippine market as it has on Indonesia. Finally, the trade combined degree of Guangxi with Singapore, Malaysia and Thailand is almost less than 1, but the trade combination index of Malaysia and Thailand to Guangxi is mostly greater than 1, which shows that Malaysia and Thailand are more dependent on Guangxi market.

In the first stage of CAFTA construction, Vietnam, Indonesia, Malaysia and Thailand have all showed close trade cooperation, with Guangxi, while Singapore and the Philippines were relatively distant. In the second stage, Guangxi’s dependence on the markets of Malaysia and Thailand had weakened, while its trade cooperation with the Philippines became closer. In the third stage, Guangxi’s dependence on Thailand has increased, and that on other countries are basically the same as the second stage (Tables 4 and 5).

Empirical model

The trade gravity model was proposed by Tinbergen (Tin et al., 1962, Poyhonen 1963). According to the two economists, the initial form of the model is stated as follows:

Tij=A(YiYj/Dij) (2)

Where Tij=the total trade volume between country or region i and country or region j

A=the trade constant

Yi=the GDP of country or region i

Yj=the GDP of country or region j

Dij=the spatial distance between country or region i and country or region j

The significance of the model is that the total volume of trade between the two trading subjects is directly proportional to the GDP of both sides and inversely proportional to the distance between the two sides.

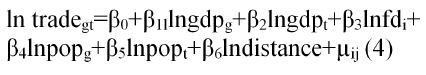

This paper extends the original trade gravity model and introduces three new variables, namely: Guangxi’s foreign direct investment, Guangxi’s population and ASEAN’s population, so as to study and analyze the influencing factors of merchandise trade between Guangxi and ASEAN countries. The extended trade gravity model finally obtained is as follows:

Tradegt=C (gdpg * gdpt * fdi * popg*popt)/distance (3)

In the formula, g=Guangxi; t=other ASEAN countries; tradegt=the total import and export trade between Guangxi and ASEAN countries; C=the trade constant; gdpg=the average income of Guangxi; gdpt=the GDP of ASEAN countries; fdi=Guangxi’s foreign direct investment; popg=the population of Guangxi; popt=the population of ASEAN countries; and distance refers to the distance between Guangxi and all ASEAN countries.

In order to avoid heteroscedasticity, a new model is constructed by taking logarithm from both sides of the equation, thus;

In the formula, β0=constant; β1, β2, β3, β4, β5 and β6=regression coefficients while μij=random error term.

Variables and their assumptions

In terms of Gross Domestic Product (GDP), the ability of a country or region to import or export largely depends on the size of its GDP. The larger the GDP, the greater the import and export capacity. The expected sign of the effect is positive.

For foreign direct investment, this may help Guangxi to achieve technological progress, which will further promote Guangxi’s export. Foreign investment and foreign trade tend to complement each other, and the increase of investment will have a positive impact on trade. The expected sign of effect is positive.

For population of a country or region, this can reflect the market size of the country or region. The more population, the greater the demand, and the more likely other countries are to export products to that country. The expected sign of effect is positive.

Distance in this paper takes the spatial distance between Nanning-the capital of Guangxi and the capital cities of ASEAN countries as the research parameters. In generally, the greater the distance between two trading entities, the higher the transportation and time costs of import and export of goods, and the trade flow will be relatively reduced. The expected sign of effect is negative.

Sources of data

This paper selected the relevant data of Guangxi and ASEAN countries from 2002 to 2018 to form a panel data covering 17 years of seven countries and regions, namely Vietnam, Indonesia, Singapore, Malaysia, Thailand, the Philippines and Guangxi Zhuang Autonomous Region of China. Due to scanty nature of some trade data from Cambodia, Laos, Myanmar and Brunei, and considering that there is less merchandise trade between these four countries and Guangxi province, and the fact that this paper focuses only on the impact of bilateral trade on Guangxi, these four countries were not taken into account in the analysis. Meanwhile, in the model, considering that the distance variable will not change with time, we directly applied the random effect to conduct the regression analysis. Among them, the total trade volume between Guangxi and ASEAN countries, Guangxi’s GDP, FDI, Population data were sourced from the Guangxi Statistical Yearbook, published by the Statistics Bureau of Guangxi Zhuang Autonomous Region in 2018. The GDP and population data of ASEAN countries were taken from the World Bank Database (2018), and the distance between Guangxi and ASEAN countries obtained from Baidu Map.

Econometric test and regression analysis

Entering In order to ensure the stability of the panel data and avoid pseudo correlation, we tested the stationarity of each variable in the trade gravity model with time using Fisher test. As shown in Table 6 below, through the Fisher test on the total trade volume between Guangxi and ASEAN countries, the GDP of ASEAN countries and the population of ASEAN countries, we found that the p-values of the four statistics corresponding to each variable were less than 0.01, so we rejected the original hypothesis of panel unit roots. Therefore, the panel data has stationarity, and there was no pseudo regression.

| lntrade | lngdpt | lnpopt | |||||

|---|---|---|---|---|---|---|---|

| t-Statistic | p-value | t-Statistic | p-value | t-Statistic | p-value | ||

Inversechi-squared (12) |

P | 56.2339 | 0.0000 | 31.0462 | 0.0019 | 30.8712 | 0.0021 |

Inverse normal |

Z | -5.6806 | 0.0000 | -3.3224 | 0.0004 | -3.1293 | 0.0009 |

Inverse logit t(34) |

L* | -6.4024 | 0.0000 | -3.3592 | 0.001 | -3.2704 | 0.0012 |

Modified inv. chi-squared |

Pm | 9.0292 | 0.0000 | 3.8878 | 0.0001 | 3.8521 | 0.0001 |

Note: * means significant levels at 10%. |

|||||||

Considering that the bilateral distance does not change with time, we chose the random effect model to study the influence of different periods and variables on the merchandise trade between Guangxi province and ASEAN countries. The construction of CAFTA was divided into three stages in order to avoid the reduction of reliability due to the short time and less data in certain stages, and the regression analysis of the three-stage model was conducted. The detailed regression analysis results are shown in Table 7 below.

|

First stage (2002-2010) |

Second stage (2002-2015) |

Third stage (2002-2018) |

|---|---|---|---|

| lngdpg | 0.631 (0.989) |

-0.0412 (0.497) |

0.197 (0.377) |

| lngdpt | 1.082 (0.637) |

1.596** (0.530) |

1.481*** (0.368) |

| lnfdi | 0.193 (0.113) |

0.0744 (0.0405) |

0.207** (0.0754) |

| lnpopg | 2.519 (19.78) |

10.30*** (2.513) |

6.074* (2.430) |

| lnpopt | -0.00643 (0.151) |

0.205 (0.185) |

0.118 (0.134) |

| lndistance | -1.946*** (0.431) |

-2.127*** (0.368) |

-2.095*** (0.250) |

| _cons | -18.16 (160.3) |

-83.97*** (22.00) |

-49.62* (20.37) |

| R2 | 0.95 | 0.95 | 0.95 |

| N | 54 | 84 | 102 |

Note: * , * * and * * * means significant levels at 10%, 5% and 1% respectively; values in brackets represent standard errors. |

|||

From the results above, the goodness of fit measured by the R-squared is 0.95, indicating a higher explanatory power of the regressors on the regrassand. In the first stage of CAFTA construction, Guangxi’s GDP, ASEAN countries’ GDP, Guangxi’s FDI, Guangxi’s population and ASEAN’s population have no significant impact on bilateral trade. This may be due to the fact that CAFTA was still under construction, and Guangxi province had had not yet established long-term and stable merchandise trade relations with ASEAN countries. However, the distance between Guangxi and ASEAN countries has a significant impact on bilateral trade, and passed the significance level test at 1% with the regression coefficient being -1.946. This means that, under the control of other variables, when the distance between ASEAN countries and Guangxi increases by 1%, the merchandise trade volume between Guangxi and other countries will decrease by 1.946%. In the second stage of the construction of free trade area, the influence of Guangxi’s GDP, FDI and the population of ASEAN countries on merchandise trade was still not significant. The reason might be that the construction of the free trade area was still at the growing stage at the time. However, at this stage, the GDP of ASEAN countries had a significant impact, which passed the significance level test at 5%. At the same time, the population of Guangxi and the distance between ASEAN countries and Guangxi also passed the significance level test at 1%, and there is a significant positive correlation between the GDP of ASEAN countries and the population of Guangxi province. More importantly, for the population of Guangxi, the correlation coefficient reached 10.3. At this stage, the population of Guangxi greatly helped to promote the development of bilateral trade. It is worth noting that the correlation coefficient of bilateral distance changed from -1.946 in the first stage to -2.127. It can be seen that with the closer trade exchanges between the two sides, distance has become an important influencing factor restricting bilateral trade. In the third stage of CAFTA construction, GDP of ASEAN countries, FDI of Guangxi, population and bilateral distance of Guangxi passed the significance level test, and the first three are significant and positively correlated, while the latter is significant but negatively correlated. Guangxi’s population is still the same as the second stage, which is the main factor which help to promote the development of bilateral merchandise trade, with the correlation coefficient of 6.074; the bilateral distance is still the main obstacle affecting bilateral trade, with the correlation coefficient of -2.095; compared with the second stage, Guangxi’s FDI also became one of the factors promoting the merchandise trade relations between Guangxi and ASEAN countries, showing a positive correlation at the significance level at 5%, with a correlation coefficient of 0.207.

Enhancing trade potentials

The value of trade potential is the result of dividing the actual amount of trade between two trading subjects and the predicted amount, which is used to estimate the development potential of trade between the two trading subjects. The formula is as follows:

TP=TV/SV (5)

In the formula, TP represents the potential value of trade between two trading entities; TV represents the actual value of total bilateral trade; SV represents the predicted value of total bilateral trade calculated by the model.

According to the value of trade potential, it can be roughly divided into three types based on the size: one is the potentials recreation, if TP>1.2, it indicates that bilateral trade is close to saturation, and both sides should look for new trade growth nodes to drive bilateral trade; the other is potential development type, at this time 0.8<TP<1.2, showing that there is certain trade potential between trade subjects, and their development space can be further expanded. The third type is great potential; TP is less than 0.8, which indicates that there is a huge trade potential between the two trade subjects. In this case, both sides should try their best to eliminate all obstacles in order to promote bilateral trade (Wan et al., 2019).

With the three-stage model, this paper calculates the forecast value of merchandise trade between Guangxi and the six ASEAN countries from 2002 to 2018, and calculates the potential value of trade between Guangxi province and other countries based on the actual value, as shown in Table 8. In the first stage of CAFTA construction, the potential values of trade between Guangxi province and Vietnam, Singapore and Malaysia were greater than 1.2, which belongs to first potential type. This shows that the merchandise trade between Guangxi and these countries is almost saturated, and it is necessary to find other trade growth points to develop the economy of Guangxi province. The value of trade potential between Guangxi and Indonesia was between 0.8 and 1.2, which belongs to the second potential type, indicating that there is certain trade potential between the two sides, and further cooperation can help achieve greater economic effects. The trade potential value of Guangxi with Thailand and the Philippines was less than 0.8, which belongs to the third potential type, indicating that the bilateral trade was still in the primary stage, and the volume of merchandise trade was far from reaching the normal level. In the second stage of CAFTA construction, the trade potential type between Guangxi and Vietnam, Singapore and Malaysia was maintained in the potential recreation, but the merchandise trade between Guangxi and Indonesia had developed further, from the original potential development type to the potential recreation. However, the momentum of merchandise trade between Guangxi and Thailand and the Philippines is still insufficient, which means there is still a huge trade potential to be developed. In the third stage of CAFTA construction, the potential value of trade between Guangxi and the six ASEAN countries declined. Since 2017, the potential value of trade between Guangxi province and Indonesia returned to between 0.8 and 1.2, and this indicates that there is still the need to break through all obstacles affecting trade and vigorously develop merchandise trade with Thailand and the Philippines.

| Country | Vietnam | Indonesia | Singapore | Malaysia | Thailand | Philippines |

|---|---|---|---|---|---|---|

Year |

||||||

| 2002 | 2.07 | 0.81 | 2.13 | 2.21 | 0.43 | 0.56 |

| 2003 | 2.18 | 0.84 | 1.48 | 2.44 | 0.38 | 0.27 |

| 2004 | 2.02 | 1.47 | 1.5 | 3.2 | 0.45 | 0.34 |

| 2005 | 1.65 | 1.09 | 2.72 | 1.25 | 0.28 | 0.3 |

| 2006 | 1.77 | 0.97 | 2.74 | 1.09 | 0.31 | 0.67 |

| 2007 | 1.91 | 0.83 | 2.89 | 1.32 | 0.28 | 0.34 |

| 2008 | 1.47 | 1.3 | 2.4 | 1.41 | 0.28 | 0.49 |

| 2009 | 1.56 | 0.98 | 2.82 | 2.78 | 0.27 | 0.3 |

| 2010 | 1.6 | 1.04 | 2.41 | 1.7 | 0.34 | 0.3 |

| 2011 | 1.67 | 1.42 | 1.47 | 1.41 | 0.25 | 0.43 |

| 2012 | 1.74 | 1.55 | 2.44 | 1.31 | 0.2 | 0.48 |

| 2013 | 1.86 | 1.36 | 3.85 | 2.98 | 0.35 | 0.4 |

| 2014 | 1.55 | 1.04 | 3.56 | 1.39 | 0.32 | 0.58 |

| 2015 | 1.86 | 1.42 | 2.95 | 1.79 | 0.25 | 0.66 |

| 2016 | 1.74 | 1.53 | 1.75 | 1.32 | 0.22 | 0.36 |

| 2017 | 1.53 | 0.73 | 2.46 | 1.84 | 0.28 | 0.69 |

| 2018 | 1.41 | 0.69 | 1.87 | 2.19 | 0.47 | 0.37 |

Source: Sorted according to "Guangxi Statistical Yearbook", World Bank Database and UN Comtrade Database. |

||||||

Conclusion

Following the results and discussions above, it is crystalline clear that Guangxi province and ASEAN countries, especially Thailand, the Philippines and Indonesia, have great development potential in commodity trading. From the perspective of trade balance, Guangxi maintains a large trade surplus with the world, and there is the need for Guangxi province to increase imports from ASEAN countries to maintain trade balance and promote sustainable economic growth. In terms of total trade volume, Guangxi should maintain the existing trade cooperation with Vietnam, Indonesia, Singapore and Malaysia, and expand the commodity trade market with Thailand, the Philippines and other ASEAN countries. From the perspective of trade integration, Guangxi province should pay more attention to the market development of Thailand and the Philippines, which are increasingly dependent, and thereby increase imports from these countries. In terms of trade potentials, Guangxi province should further deepen cooperation with other countries such as Indonesia, Thailand and the Philippines, so as to help drive Guangxi’s economic growth through commodity trade. Finally, through the expansion of trade gravity model, we can see that the bilateral distance will hinder the development of bilateral trade, while the GDP of ASEAN countries, FDI in Guangxi and the development of Guangxi’s population have a favorable impact on the commodity trade between Guangxi province and ASEAN countries. Therefore, to achieve sustainable economic growth in Guangxi province, it is necessary not only to distinguish the main subjects of cooperation, but also to consider ways of reducing the main factors affecting trade relations between these regions.

Suggestions

Finally, the following suggestions have been put forward for consideration by stakeholders to help improve trade relations between Guangxi province and ASEAN countries.

Establish multilateral cooperation mechanism with ASEAN countries: With the development opportunity of ‘the Belt and Road Initiative’, Guangxi province and ASEAN countries should expand the breadth and depth of cooperation, remove all obstacles, and further increase Guangxi’s import of goods, and this can lead to Guangxi’s import and export trade to balance. Furthermore, Guangxi province should deal with the relationship with ASEAN countries, increase ASEAN’s dependence on Guangxi’s commodities by means of cultural export, so as to promote the growth of GDP and Guangxi’s economy.

Improve the living conditions of people: The government of the autonomous region of Guangxi should encourage qualified families to have two children so as to realize the population growth in the third stage of CAFTA construction. At the same time, the government also needs to increase publicity and investment in education to improve the quality, income and living standards of people, so as to make full use of the population advantage and improve the productivity and consumption potential of the whole society in Guangxi province.

Stabilize the foreign direct investment in Guangxi province: Guangxi province should make efforts to increase the introduction of foreign capital, attract the inflow of foreign capital through relevant policies, financing and other means, and fully protect the legitimate rights and interests of foreign investors, and create a harmonious business atmosphere for foreign firms to thrive. In addition, Guangxi province can build a stable supply chain for itself according to the comparative advantages of various regions, so as to stabilize its foreign investment.

Improve the construction of traffic: The spatial distance between Guangxi province and ASEAN countries is an inherent natural attribute between regions, which cannot be changed by external forces. However, the time distance can be shorten by improving the infrastructure of both sides. Guangxi province should improve its own infrastructure construction and help ASEAN countries develop flexible transportation and communication industry, through the convenient railway, highway, sea, air transportation and multimodal transport to realize the rapid transfer of materials, reduce the transportation cost and time cost of goods.

This paper is supported financially by the Construction of the Demonstration Base for the Industrial Development and Utilization of the Marine Resources in Beibu Gulf University (Project No. GUIKE AD17195082), the Beibu Gulf Ocean Development Research Center, as well as the Research on Port Resource Allocation Efficiency and Logistics Capability Improvement of Beibu Gulf Port (Poject No. BHZKY202018).

Select your language of interest to view the total content in your interested language